Table of Contents

Top Business Credit Cards for Small Merchants in 2025

In today’s competitive retail landscape, small merchants using POS systems face steep processing fees that can erode profits on every transaction. Selecting the best business credit cards equips your business with tools to offset these costs through targeted rewards on daily sales and supplies purchases. At The POS Brokers, we advise pairing these cards with integrated payment solutions for seamless cash flow management.

Business cards separate expenses, build credit, and offer perks like cashback on office essentials and enhanced points for restaurant inventory. Looking to 2025, expect trends such as deeper digital wallet integrations and sustainable spending bonuses from issuers like Chase and American Express, with average rewards rates hitting 2-5% on key categories per The Points Guy insights.

To maximize value, assess your annual spend on processing and supplies; a strong sign-up bonus could yield thousands in rewards, complementing The POS Brokers’ next-day deposits for faster liquidity.

1. Unlimited Cashback Rewards

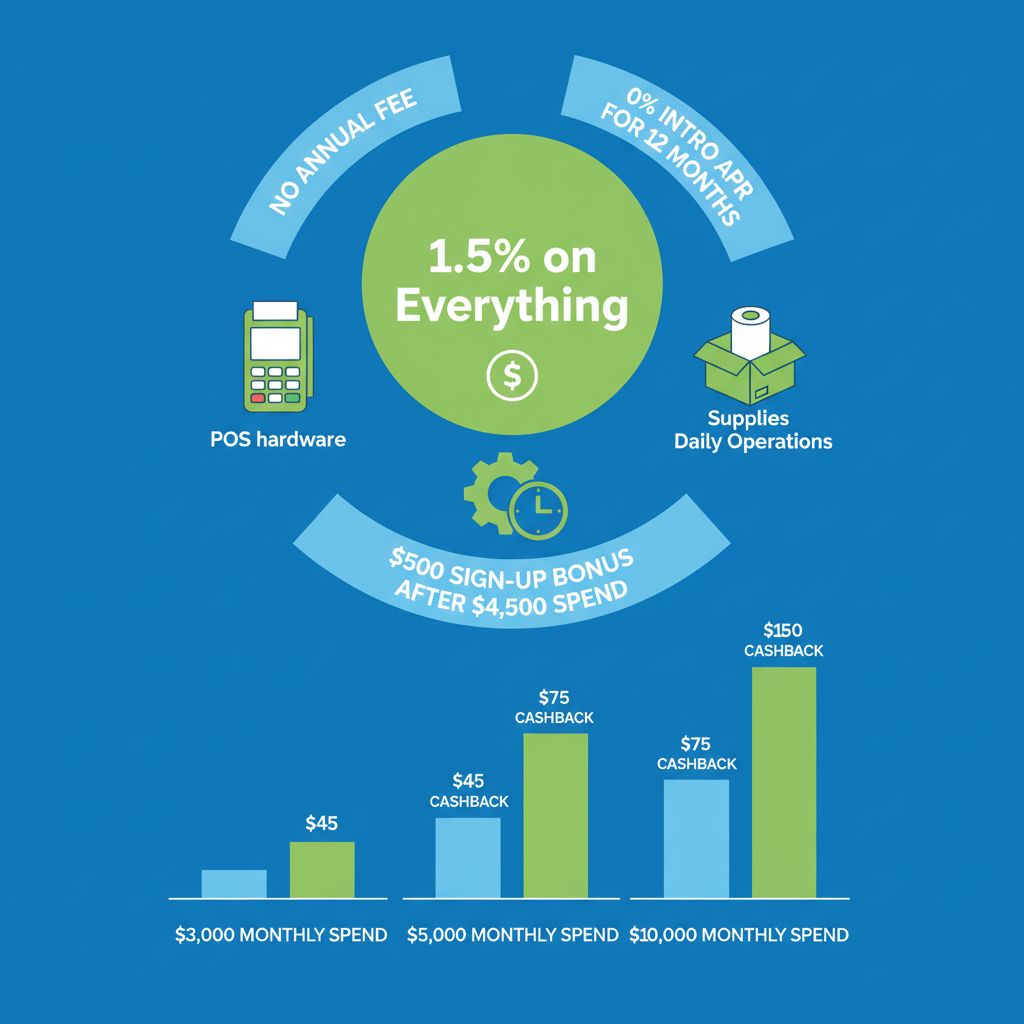

For small merchants navigating unpredictable expenses like POS hardware and inventory, the best business credit cards offer simplicity and real value. This top option stands out with unlimited 1.5% cashback on every purchase, providing a reliable way to earn on daily operations without complex categories.

- No annual fee and 0% introductory APR for 12 months on purchases, easing startup costs for new ventures.

- A $500 sign-up bonus after spending $4,500 within the first three months, ideal for stocking up on supplies.

- Flexible redemptions as statement credits or checks, giving businesses control over fund allocation.

Compared to basic 1% flat credit cards, this delivers 50% more rewards, making it a superior choice for no-fee corporate cards. Merchants can apply for these business cards easily online, with quick approval for established operations.

Unlimited 1.5% cashback rewards infographic for small business merchants

Consider a retail store buying inventory; earning 1.5% cashback could offset costs for devices like the Clover Flex POS, priced around $295. Use rewards to fund free Clover placements through The POS Brokers, empowering your business with seamless payment integrations and financial flexibility.

2. Travel Perks for Mobile Sellers

For mobile sellers like food truck owners relying on portable POS systems, the best business credit cards with travel rewards can transform road trips into profitable adventures. These travel rewards business cards earn points on essential expenses, supporting dynamic operations without draining cash flow.

Imagine earning 2x points on gas, hotels, and flights with select credit cards, plus 1x on all other purchases. The $95 annual fee is easily offset by a $100 airline incidental credit, making it a smart pick for on-the-go merchants. New cardholders snag a 60,000-point welcome bonus after spending $4,000 in the first three months—worth about $750 in travel value at 1.25 cents per point. Robust travel protections include trip delay insurance up to $500 and baggage delay coverage, ensuring peace of mind during busy routes. For eligibility, business cards typically require a solid credit score and proof of business activity, like sales records from your mobile setup. Pair this with clover mini zero fee processing for next-day deposits that keep funds flowing seamlessly alongside rewards accumulation.

- Redeem points for flights at 1.25 cents each to cover a cross-country food truck tour.

- Use hotel bookings for vendor events, stretching every penny further.

A food truck operator in Texas redeemed points for $300 in gas credits last year, fueling a festival circuit while tracking expenses via integrated Clover tools—ideal for 2025’s expanding mobile markets.

3. Office Supply Bonuses

For merchants seeking the best business credit cards to offset routine expenses, office supply bonuses stand out as a smart choice. These supply rewards cards deliver substantial returns on everyday purchases like staples, printers, and POS peripherals, helping retail operations in California save significantly on essential inventory without annual fees.

Among top credit cards, this option earns 5x points on office supplies up to $25,000 annually, alongside 2x points on gas and dining. New cardholders receive an 80,000-point welcome bonus after spending $4,000 in the first three months. Redemption flexibility includes travel bookings or cash back at one cent per point, plus robust purchase protections like extended warranties and price protection. Key reward categories include:

- Office supplies (5x up to $25,000/year)

- Gas stations (2x unlimited)

- Dining establishments (2x unlimited)

This retail bonus credit aligns perfectly with merchant needs, transitioning from travel perks to stationary essentials before enhancing dining rewards for restaurant owners.

Maximize earnings by pairing with POS accessory buys from The POS Brokers. For instance, purchasing a clover mini pos system priced at $349 qualifies for 5x points, yielding 1,745 points toward future redemptions. Apply online with your business details for quick approval, ensuring seamless integration into operations.

4. Dining and Gas Rewards

For food and beverage merchants juggling high-volume orders through POS systems, the best business credit cards can turn everyday expenses into valuable perks. Restaurant owners and delivery services often face steep costs for dining supplies and fuel, making targeted rewards essential to offset these operational hits.

This standout card earns 4x points on restaurant purchases up to $150,000 annually, perfect for credit cards handling dine-in or takeout mechanics. It also provides 2x points on gas, ideal for fuel bonus options in mobile delivery fleets. With a $95 annual fee, new cardholders receive a 75,000-point welcome bonus, redeemable for travel at 1 cent per point. Additional benefits include extended warranties on business purchases, complementing The POS Brokers’ restaurant POS solutions like the affordable Dejavoo QD4 mobile terminal for on-the-go gas payments.

Consider a busy Houston eatery redeeming points to cover supplier invoices, effectively reducing credit card debt through strategic rewards. Pair this with business cards eligible for restaurant operations to maximize earnings and streamline cash flow for growth.

5. Advertising Spend Boost

Among the best business credit cards available, those designed for advertising rewards stand out for merchants expanding their digital presence. These ad rewards cards offer substantial bonuses on promotional spends, helping businesses leverage POS analytics for more effective targeting. For instance, integrating with systems like the clover flex pos system allows merchants to analyze customer data and refine ad campaigns accordingly.

Credit cards with tailored rewards provide 3x points on advertising purchases up to $150,000 annually, plus 2x on travel expenses. New cardholders often receive a 100,000-point welcome bonus after meeting a spending threshold, with no annual fee to maximize value. Flexible redemption options include statement credits or travel bookings, while built-in cellphone protection covers up to $1,000 per incident for mobile devices used in business operations. How does a credit card work in this context? Points accumulate based on eligible categories like online ads or print media, redeemable at a fixed value to offset marketing costs. The Dejavoo Z8 terminal enhances this by offering pricing synergy for in-store promotions, tying ad efforts to real-time sales data from The POS Brokers’ integrated reporting. Merchants can run targeted Facebook ads or Google campaigns based on POS insights, boosting ROI on growth spends that build on daily operations.

Business cards like these empower merchants to scale marketing without excessive costs, combining ad bonuses with POS-driven strategies for sustained expansion.

6. Flexible Intro APR

Among the best business credit cards available, one standout option features a generous 0% introductory APR on purchases and balance transfers for 18 months. This allows merchants to finance essential equipment, such as a refurbished Clover Mini POS system priced at around $295, without accruing interest during that period. After the intro, a variable APR applies, but the long interest-free window gives ample time to pay down balances strategically.

Rewards on everyday purchases add value, earning points redeemable for business expenses. For those wondering how to pay off credit card debt, this card promotes disciplined repayment by eliminating interest charges initially. Merchants can use it to acquire pos systems or accessories from providers like The POS Brokers, spreading costs over time. No balance transfer fee enhances its appeal for consolidating existing credit cards or business cards debts. By prioritizing high-interest payments first and leveraging the intro period, business owners minimize long-term costs and maintain cash flow for operations.

7. Employee Card Controls

In multi-user POS environments, managing team finances requires robust controls to prevent overspending and enhance security. Business credit cards with employee card controls offer a practical solution, allowing unlimited employee cards issued under a primary account. These best business credit cards enable administrators to set spending limits, track transactions in real-time, and assign cards to specific departments or roles, addressing common team management questions like how to monitor employee purchases without micromanaging.

Key features include customizable limits per card, such as daily or category-based caps on credit cards for supplies or travel, paired with rewarding points or cashback on qualifying spends. Importantly, there are no additional fees for issuing these business cards, making it cost-effective for small to mid-size merchants using POS systems. For added security, integrate PIN-enabled terminals like the Clover Mini with PIN for debit transactions, ensuring only authorized users complete purchases and reducing fraud risks in busy retail or restaurant settings.

This functionality transitions seamlessly to advanced features, empowering businesses to scale operations confidently while maintaining financial oversight.

8. Premium Perks Package

For growing merchants handling high-volume transactions through advanced pos systems, the Premium Perks Package stands out among the best business credit cards. This high-end option is tailored for business owners who frequently travel for supplier meetings, trade shows, or expanding operations. With a $450 annual fee, it delivers substantial value through exclusive benefits that enhance both personal and professional mobility.

Earn 1.5x miles on every purchase, accelerating rewards on everyday business expenses like POS hardware upgrades or inventory restocking. Key perks include unlimited access to airport lounges worldwide, comprehensive travel insurance covering trip delays, baggage loss, and emergency medical evacuation, plus elite status with major airlines and hotels. These features are ideal for luxury merchant scenarios, such as fine dining restaurant owners jetting to source premium ingredients or retail executives networking at industry events. As the pinnacle of our list, this package ensures seamless integration with your credit cards and business cards strategy, paving the way for a holistic financial overview in the next section.

Selecting Your Ideal Business Card

In evaluating the best business credit cards, key factors like rewards categories aligned with spending—such as travel perks or cash back—annual fees, and welcome bonuses stand out. For small merchants, options like no-fee cards suit startups, while premium business cards offer enhanced digital perks in 2025 trends. According to The Points Guy, average ROI from rewards can exceed 2-3% on business expenses, validating strong selections for optimal merchant cards.

Assess your business type: retail setups benefit from POS-integrated credit cards, while mobile operations prioritize flexible finance tools for SMBs. Start with low-barrier business cards if you’re new, ensuring alignment with financial goals like expense tracking or tax deductions.

To maximize value, pair your chosen credit card with seamless POS solutions from The POS Brokers. Our experts guide merchants through integrations for efficient payments and growth. Contact us today for a personalized consultation and elevate your business finance strategy.

Resources

- Get Free Clover Flex POS System with Zero Fees

- Get Clover Mini POS with Zero Credit Card Fees

- Explore Compact Clover Mini POS for Contactless Payments

- Find Dejavoo QD4 POS Terminal for Business Efficiency

- Secure Dejavoo Z8 POS System with Free Hardware

- Obtain Refurbished Clover Mini POS at No Cost

- Acquire Clover Mini POS with PIN Debit Terminal

- Discover Top Business Credit Cards for Maximum Rewards