Table of Contents

- Navigating PayPal Goods and Services Fees for Businesses

- PayPal Goods and Services

- PayPal Fee Calculator

- POS Systems as PayPal Alternatives

- Comparing Payment Tools and Fees

- POS Systems Catalog

- Optimizing Payment Fees with POS Brokers

Navigating PayPal Goods and Services Fees for Businesses

Imagine a busy restaurant in Houston processing lunch orders via PayPal, only to find a significant chunk of each sale disappearing into fees. This common scenario highlights the paypal goods and services fee challenge for small US merchants. Understanding these costs is crucial for maintaining profitability in retail and food service industries.

The paypal goods and services represents PayPal’s standard option for commercial transactions, offering built-in protections for both buyers and sellers against fraud and disputes. Unlike the fee-free Friends and Family option reserved for personal transfers, it applies a percentage plus fixed amount to every sale, such as the current 2.99% plus $0.49 per domestic transaction as outlined in PayPal business fees. This structure covers PayPal transaction fees for merchandise while providing seller protection costs that safeguard against chargebacks. Many businesses overlook these details, leading to misconceptions about waivers or hidden extras, but tools like a paypal fee calculator can clarify exact impacts. For e-commerce sellers, average monthly fees often exceed $500, straining tight budgets according to industry insights.

At The POS Brokers, we specialize in brokering integrated POS solutions for US restaurants and retailers that seamlessly complement PayPal or shift to lower-cost alternatives. Our advisors deliver wholesale rates, free hardware placements, and next-day deposits, helping merchants like yours optimize payments without the full burden of standalone PayPal reliance.

This guide breaks down essential tools, including fee calculators and comparisons, to empower informed decisions. Upcoming sections explore these options in detail, ensuring your business navigates fees efficiently.

PayPal Goods and Services

PayPal Goods and Services serves as a reliable payment option for small US merchants handling retail and e-commerce transactions, offering built-in dispute resolution that the paypal goods and services fee enables through seller protections. Targeted at sellers needing secure, covered payments, it distinguishes from informal options like friends and family by providing formal safeguards against chargebacks and fraud, ensuring safer exchanges for both buyers and sellers in everyday business scenarios.

Key Features

- Buyer and Seller Protections: Covers eligible purchases up to $20,000 with reimbursement for unauthorized transactions or items not received, as outlined in PayPal’s business policies, making it safe for buyers in retail settings.

- Invoice Tools: Allows merchants to send professional invoices with payment requests, supporting one-time or recurring billing for restaurant or store clients.

- International Support: Facilitates cross-border payments with currency conversion, ideal for US-based sellers expanding globally.

- Easy Integration: Connects seamlessly with POS systems like Clover or Revel through The POS Brokers, enabling in-person sales acceptance.

- Dispute Resolution: Built-in tools handle claims efficiently, reducing resolution time compared to personal transfers.

Pricing

Standard rates for domestic transactions in the US include 2.99% plus $0.49 per sale, with international fees rising to 4.4% plus a fixed amount based on currency. For a $500 retail sale, expect around $15.44 in protected payment fees. Use a PayPal fee calculator to compute exact costs for varying transaction sizes and avoid surprises in budgeting.

Pros and Cons

Pros:

- Robust safeguards enhance transaction security for e-commerce and in-person sales.

- Quick setup with minimal paperwork, perfect for new US merchants.

- Versatile tools support diverse business needs, from invoicing to POS integration via The POS Brokers.

Cons:

- Higher PayPal commercial transaction charges compared to cash discount programs.

- Potential holds on funds during disputes, delaying access to earnings.

- Limited customization for high-volume operations without premium accounts.

Ideal for retail and restaurant owners in the US seeking protected payments, such as food truck operators processing $500 daily sales through integrated POS setups. The POS Brokers offers free demos to optimize PayPal Goods and Services with systems like Clover, helping minimize fees while maximizing efficiency—contact them for tailored advice on safe transaction handling.

PayPal Fee Calculator

For US business owners handling online sales, the PayPal Fee Calculator serves as a straightforward tool to estimate costs for goods and services transactions. It allows sellers to quickly forecast fees without complex spreadsheets, aligning with The POS Brokers’ advice on transparent payment processing. This PayPal cost estimation tool helps merchants understand transaction fee breakdowns upfront.

Features

The paypal fee calculator offers user-friendly inputs for transaction amount and type, focusing on paypal goods and services. Users enter details like a $100 sale, and it instantly displays the paypal goods and services fee, typically 2.99% plus $0.49 fixed, resulting in about $3.48 for that example. Additional options include selecting domestic or international transfers.

- Simple input fields for amount, currency, and transaction category.

- Instant results showing total fees and net amount received.

- Export functionality to save calculations as PDFs or spreadsheets for record-keeping.

To use it, follow these steps: 1. Visit PayPal’s site and locate the calculator. 2. Input the sale amount, such as $100 for a product. 3. Select goods and services as the type. 4. Review the breakdown, which deducts fees to show your $96.52 net.

Pricing

Access to the PayPal Fee Calculator is completely free, requiring only a PayPal account for enhanced personalization, with no hidden charges or subscriptions.

Pros and Cons

This tool shines in providing quick insights but has limitations for comprehensive planning.

- Pros: Delivers accurate estimates based on current rates, saving time for busy sellers.

- Pros: Supports easy comparisons between transaction types, aiding budget forecasts.

- Pros: Integrates seamlessly with PayPal’s ecosystem, as noted in Zapier reports on payment gateways, where 70% of merchants value such compatibility for POS setups.

- Cons: Overlooks variables like currency conversion fees, prompting exploration of PayPal alternatives for potentially lower costs, per BitDegree analyses showing competitors with rates under 2.5%.

Best For

The paypal fee calculator suits retail owners budgeting for e-commerce volumes or comparing processors before committing. The POS Brokers recommends using it alongside consultations for wholesale POS rates, ensuring fees align with overall merchant account strategies, especially for US-based operations.

POS Systems as PayPal Alternatives

For businesses tired of the standard paypal goods and services fee, POS systems brokered by The POS Brokers offer a compelling alternative. These integrated platforms, such as Clover, help US retail and restaurant owners reduce paypal goods and services costs while streamlining operations. By shifting to brokered POS solutions, merchants can avoid high online transaction fees and embrace efficient in-person processing tailored for small to mid-size businesses.

Key Features of Brokered POS Systems

The POS Brokers provides comprehensive POS systems with features designed for seamless daily use:

- Integrated Payments: Accept credit, debit, ACH, and even PayPal or Venmo directly at the point of sale, minimizing integrated POS transaction costs compared to standalone online gateways.

- Inventory Management: Track stock in real-time, ideal for restaurants handling perishable goods, preventing overstock and waste.

- Reporting Tools: Generate detailed sales analytics and use a paypal fee calculator equivalent to monitor merchant processing charges and profitability.

These tools ensure robust protection for sellers, covering disputes similar to PayPal’s safeguards but with added local oversight.

Pricing and Accessibility

Under the POS payment policy, The POS Brokers offers wholesale rates of 2.2% + $0.10 per transaction, often lower than typical PayPal rates. Qualifying merchants access free hardware placements, including Clover countertop systems starting at no upfront cost.

Pros and Cons

Pros include an all-in-one solution that combines payments, inventory, and reporting, backed by 24/7 support from The POS Brokers’ Simi Valley team. Local expertise aids quick setups, and free Clover hardware reduces initial barriers for restaurants. Cons involve some setup time for integration and the need for compatible hardware, which may require shipping across the US. Overall, these systems provide balanced protection against fraud, much like PayPal, but with cost efficiencies for in-person sales.

Best For

Brokered POS systems suit in-person sellers seeking complements to PayPal, especially full-service restaurants in the US. For instance, a California eatery can use Clover for counter transactions, slashing fees while maintaining seller protections and next-day deposits.

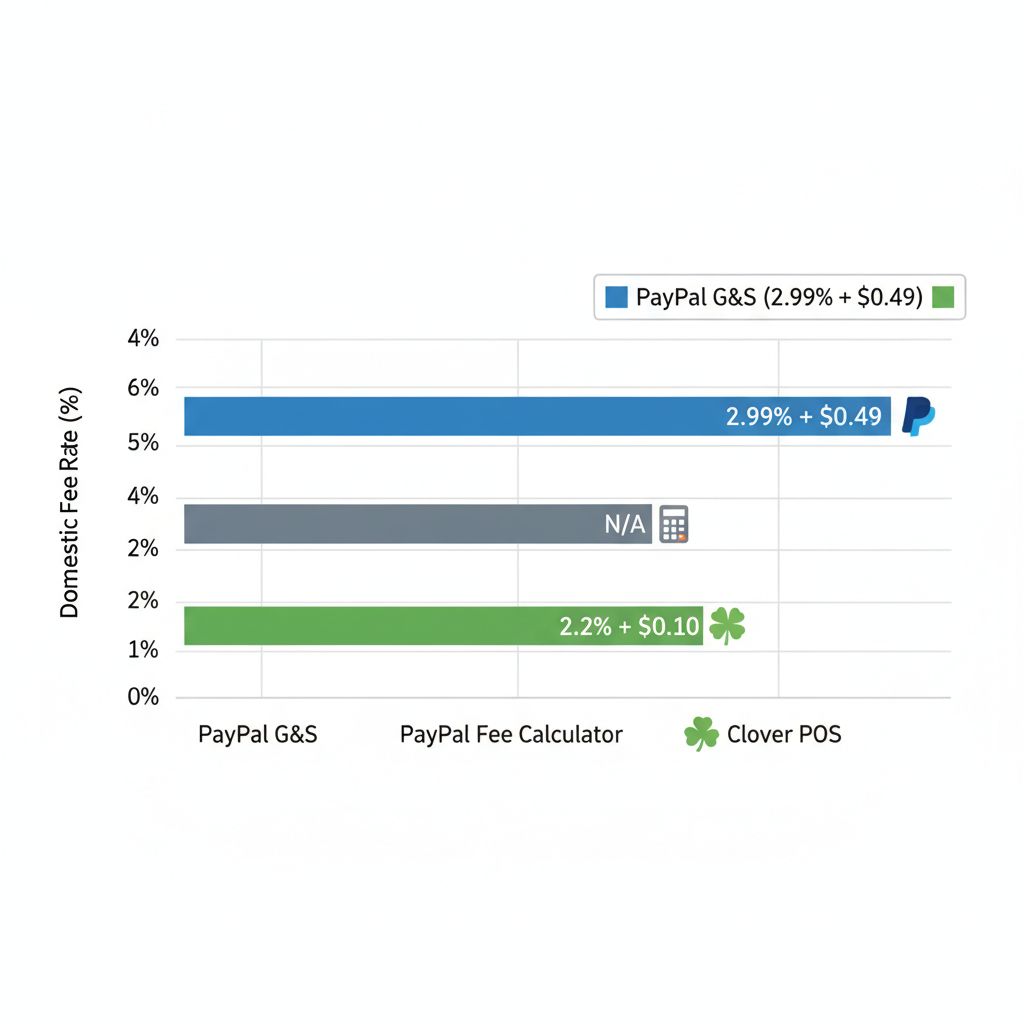

Comparing Payment Tools and Fees

For US small businesses navigating the paypal goods and services fee, a clear fee comparison across tools is essential to optimize processing costs. This section compares PayPal Goods and Services, the paypal fee calculator, and Clover POS systems from The POS Brokers, focusing on rates, protections, and integration for informed decision-making in retail scenarios.

The following table highlights key differences to help merchants evaluate options for efficient payment handling:

| Feature | PayPal Goods and Services | PayPal Fee Calculator | Clover POS (via The POS Brokers) |

|---|---|---|---|

| Fee Rate (Domestic) | 2.99% + $0.49 | N/A (Estimation Tool) | 2.2% + $0.10 (Wholesale) |

| Seller Protections | Full Dispute Resolution | N/A | Chargeback Assistance Included |

| Integration Ease | API Available | Web-Based | Native POS Setup |

| Best Use Case | Online Sales | Fee Forecasting | In-Person Retail |

Data sourced from official PayPal rates as of 2024 and The POS Brokers’ wholesale programs. This processing cost analysis reveals significant advantages for POS alternatives in domestic transactions. For instance, on a standard $100 sale, paypal goods and services incurs about $3.49 in fees, while Clover POS reduces this to roughly $2.30—a 34% savings that supports tighter margins for small retailers. The POS Brokers enhances affordability with hardware like Clover countertop systems priced at $295, as listed on their shop pages, making setup accessible without high upfront costs.

Domestic fee rates comparison for PayPal and Clover POS systems

Beyond fees, Clover POS stands out with robust chargeback assistance and seamless native setup, ideal for in-person retail where quick transactions matter. While PayPal tools suit online sales and basic forecasting, they lack comprehensive protections for physical stores. For US businesses, especially restaurants and retail outlets, The POS Brokers’ Clover options minimize long-term costs through wholesale rates and free placements.

Choose based on your operations: opt for POS if in-person volume dominates, or PayPal for e-commerce. Contact The POS Brokers for a personalized consultation to align tools with your needs.

POS Systems Catalog

Explore The POS Brokers’ POS systems catalog for PayPal-compatible point-of-sale systems designed to minimize paypal goods and services fee costs. Starting at just $295, options include Clover countertop systems and kitchen displays up to $595. These affordable solutions integrate seamlessly with PayPal goods and services, helping merchants optimize payments without high transaction fees. Browse the full selection to find the perfect fit for your business needs.

Optimizing Payment Fees with POS Brokers

Navigating the complexities of the paypal goods and services fee can be challenging for US merchants, as these charges often add up quickly for online and in-person transactions. Tools like the paypal fee calculator help estimate costs, but they reveal persistent hurdles in maintaining profitability with paypal goods and services. By recapping earlier insights, including fee structures from comparison tables, merchants can see how optimized merchant fees become essential for long-term success. The good news is that switching to integrated POS systems offers substantial POS cost savings, reducing the burden of these fees through efficient processing and bundled solutions.

To achieve these benefits, contact The POS Brokers today for a personalized demo or consultation. Their experts in Simi Valley, CA, provide 24/7 support, free placements for qualifying merchants, and access to affordable hardware starting at $295 for Clover countertop systems. Explore POS solutions selection to find the right fit that lowers your overall costs and streamlines operations. Reach out via phone at their Simi Valley headquarters or email for same-day setup and next-day deposits, ensuring your business thrives without hidden paypal goods and services fee pitfalls.

Resources

- Discover Free POS Hardware and Zero-Fee Processing Policy

- Explore POS Systems Catalog with Free Clover Options

- Select Tailored POS Solutions for Restaurants and Retail

- Find Diverse POS Hardware Options with Advisor Support

- Obtain Free POS Systems and Cash Discount Program

- Access POS Broker Services for Free Hardware Setup

- Get POS Systems Overview with Quick Deposits Integration

- Earn Crypto Rewards Through Gamified Web3 Learning Missions

- Use PayPal Fees Calculator for Wise Transfer Savings

- Review PayPal Business Fees for Cost Management

- Guide to 2025 PayPal Fees for Shopify Sellers

- Integrate Payment Gateways with Zapier Automation Tools